The Eb5 Investment Immigration PDFs

The Eb5 Investment Immigration PDFs

Blog Article

The Buzz on Eb5 Investment Immigration

Table of ContentsEb5 Investment Immigration for DummiesHow Eb5 Investment Immigration can Save You Time, Stress, and Money.Everything about Eb5 Investment ImmigrationThe smart Trick of Eb5 Investment Immigration That Nobody is Talking AboutExcitement About Eb5 Investment Immigration

Contiguity is developed if census systems share boundaries. To the extent possible, the combined census tracts for TEAs must be within one city location without even more than 20 demographics tracts in a TEA. The combined census tracts should be an uniform shape and the address ought to be centrally located.For more details about the program go to the U.S. Citizenship and Immigration Solutions web site. Please allow 30 days to process your demand. We generally react within 5-10 organization days of obtaining qualification demands.

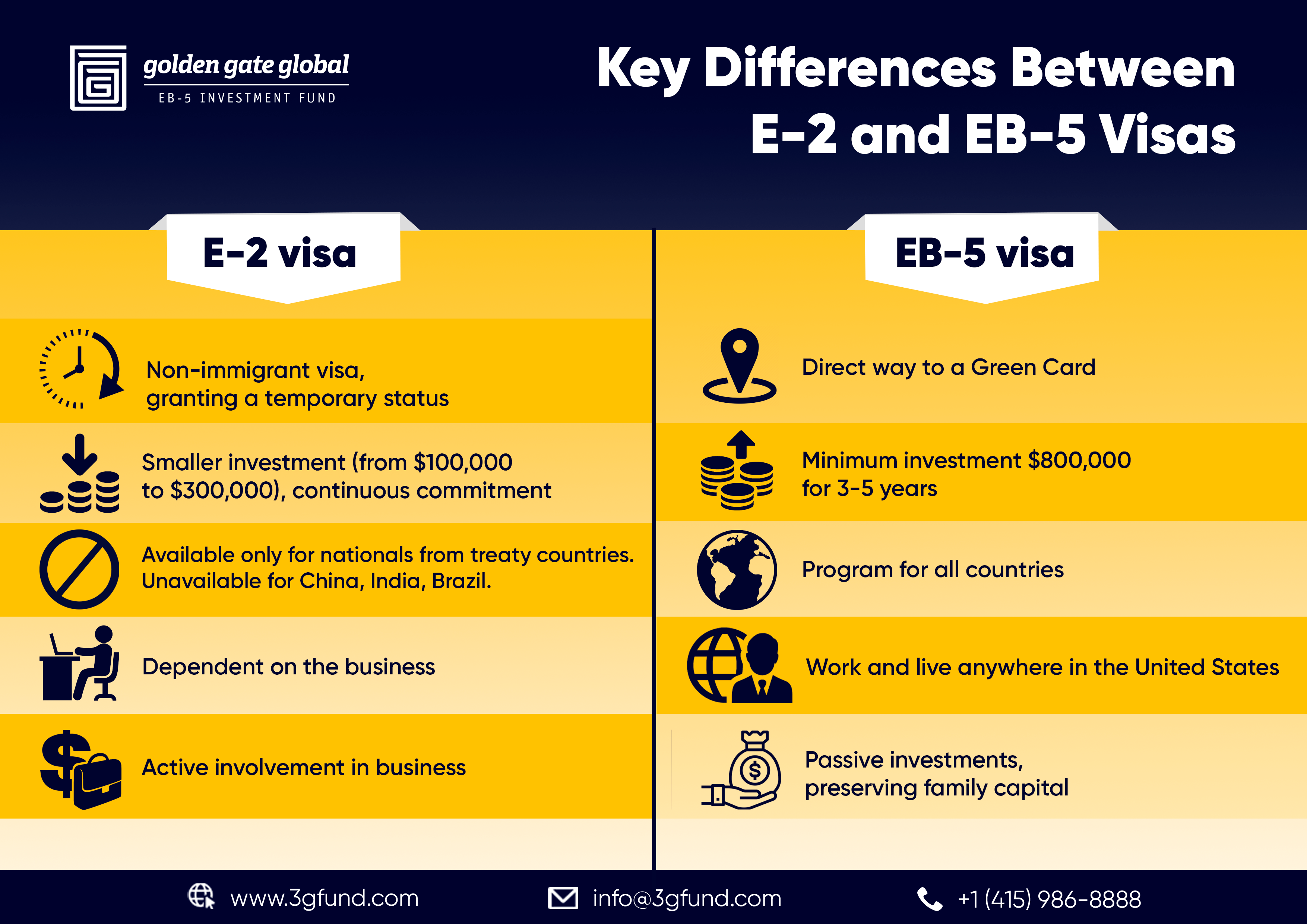

The United state government has taken actions aimed at increasing the degree of international financial investment for virtually a century. This program was broadened through the Migration and Citizenship Act (INA) of 1952, which created the E-2 treaty capitalist course to further bring in foreign investment.

employees within two years of the immigrant capitalist's admission to the United States (or in certain situations, within an affordable time after the two-year period). In addition, USCIS may attribute financiers with preserving work in a distressed business, which is specified as an enterprise that has actually been in presence for a minimum of 2 years and has endured a web loss throughout either the previous one year or 24 months prior to the concern day on the immigrant investor's preliminary petition.

The Main Principles Of Eb5 Investment Immigration

The program preserves rigorous capital requirements, needing candidates to show a minimal qualifying investment of $1 million, or $500,000 if bought "Targeted Work Locations" (TEA), which consist of certain designated high-unemployment or backwoods. The majority of the authorized local facilities create financial investment opportunities that are situated in TEAs, which qualifies their foreign investors for the lower investment threshold.

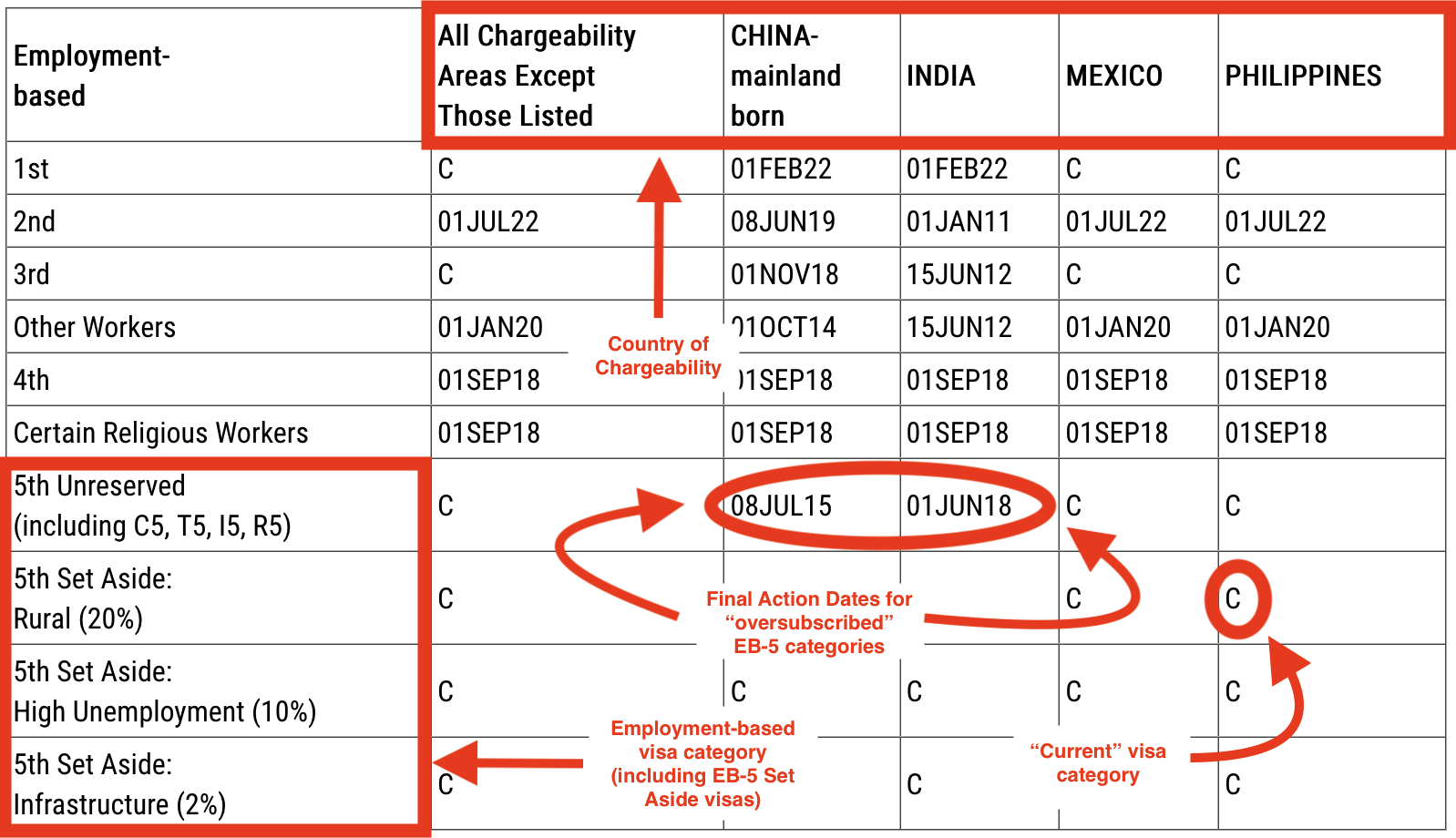

To qualify for an EB-5 visa, an investor has to: Spend or be in the process of spending at least $1.05 million in a new industrial enterprise in the United States or Spend or be in the process of investing at the very least $800,000 in a Targeted Employment Location. One method is by establishing up the financial investment business in a financially challenged location. You may add a lower commercial financial investment of $800,000 in a rural location with less than 20,000 in populace.

Top Guidelines Of Eb5 Investment Immigration

Regional Facility financial investments enable for the factor to consider of financial influence on the regional economic situation in the kind of indirect employment. Any financier taking into consideration investing with a Regional Center need to be really mindful to consider the experience and success rate of the firm prior to investing.

The financier initially requires to submit an I-526 application with united state Citizenship and Migration Provider (USCIS). This application needs to consist of proof that the financial investment will produce full time work for at the very least 10 united state residents, permanent residents, or other immigrants that are licensed to work in the United States. After USCIS accepts the I-526 petition, the financier may get a permit.

Eb5 Investment Immigration - Questions

If the capitalist more info here is outside pop over to this site the United States, they will need to go with consular handling. Investor eco-friendly cards come with conditions connected.

The brand-new area typically permits good-faith financiers to keep their eligibility after discontinuation of their regional facility or debarment of their NCE or JCE. After we notify capitalists of the discontinuation or debarment, they may retain qualification either by alerting us that they continue to satisfy eligibility needs regardless of the termination or debarment, or by amending their petition to reveal that they satisfy the demands under section 203(b)( 5 )(M)(ii) of the INA (which has various needs depending on whether the investor is looking for to maintain eligibility since their regional center was ended or since their NCE or JCE was debarred).

In all cases, we will certainly make such resolutions regular with USCIS policy concerning deference to previous determinations to make sure consistent adjudication. After we end a regional center's classification, we will certainly revoke any type of Kind I-956F, Application for Authorization of an Investment in a Business, connected with the ended regional center if the Form I-956F was accepted since the day on the regional facility's discontinuation notification.

The smart Trick of Eb5 Investment Immigration That Nobody is Discussing

Report this page